Over the past few posts, we've journeyed from the pressing challenges facing our creative and journalistic landscapes to the core ideas powering InHouse Journal (IHJ). We've talked about the limitations of current funding models, introduced the concept of Story-Stocks as a new way to share in a project's success, explored their mechanics, and delved into the kind of integrated, trust-based ecosystem required to make such innovations thrive.

It’s a lot to consider, because what we're proposing isn't just a new feature or a minor tweak. It's an attempt to fundamentally rethink how vital stories get told, how ambitious creative endeavors are funded, and how communities can become true partners in this process.

Our Vision: A Thriving Ecosystem for Impactful Work

So, what's the future we're working towards here at InHouse Journal, from our starting point in Austin in May 2025? We envision a world where financial viability and profound creative or journalistic impact are not at odds, but actively reinforce each other. A world where:

- Journalists can pursue the deep, difficult investigations our communities desperately need, backed by those communities directly, with greater autonomy and a sustainable income model.

- Creators of all stripes—novelists, filmmakers, podcasters, artists—can fund their most ambitious visions without solely relying on traditional gatekeepers or models that don't fully align with their long-term success.

- Backers and supporters move beyond being passive consumers or donors to become active stakeholders, sharing in the journey, the impact, and potentially the financial rewards of the specific works they champion.

- Trust is not just a buzzword, but a tangible reality, engineered into the very fabric of the platforms that facilitate these creative and financial exchanges through transparency, accountability, and clear rules.

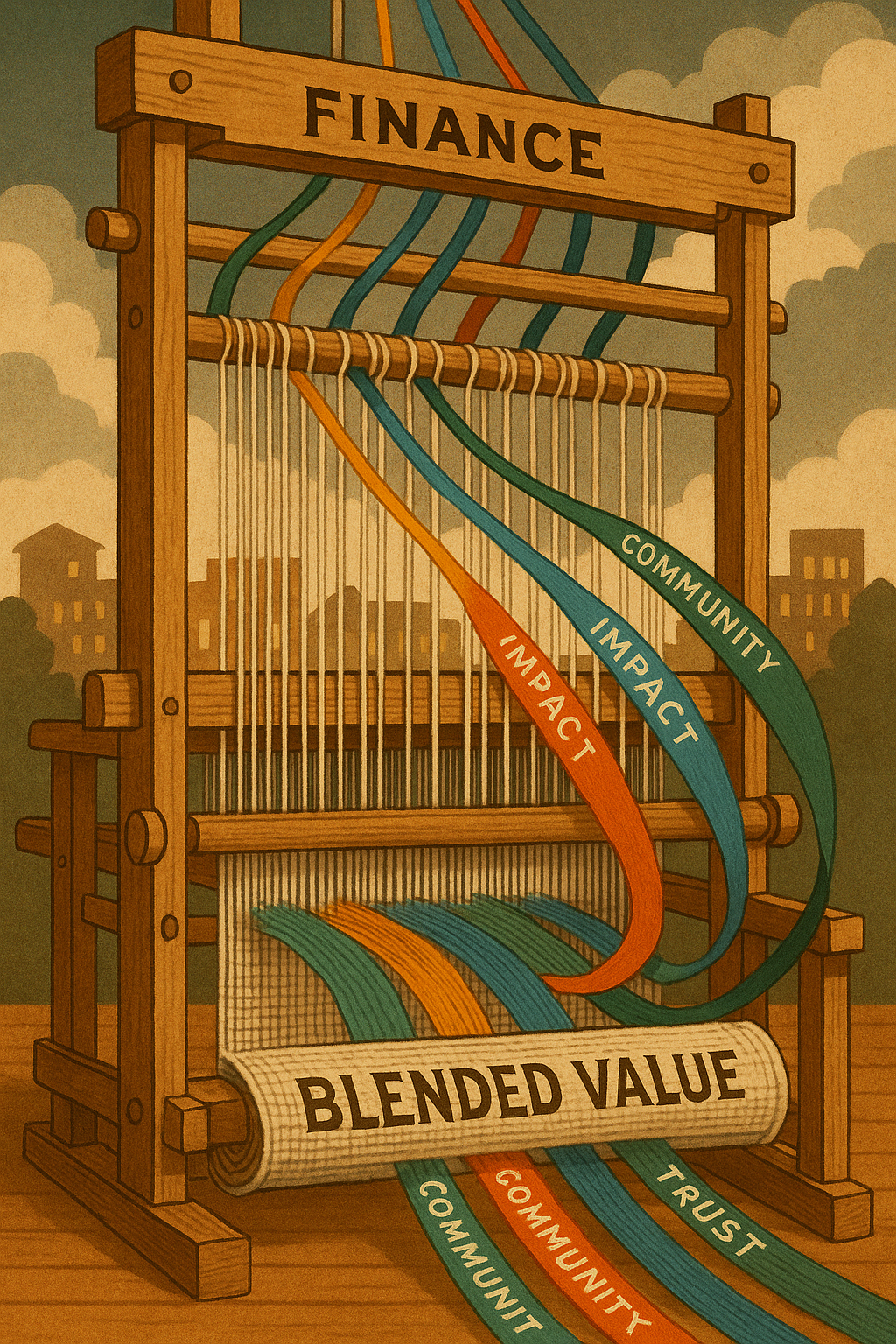

This is the “Interdisciplinary Atoll” we aim to cultivate—a vibrant, resilient space where the sophisticated integration of technology, finance, media understanding, legal frameworks, and deep respect for human dynamics allows new forms of value to flourish. It’s about playing “Capitalism on Hard Mode,” intentionally, because we believe the rewards, for everyone involved, are worth the rigor.

This Isn’t Just IHJ’s Story—It’s Ours, Collectively

Building this future isn’t something InHouse Journal can, or wants to, do in isolation. The challenges are too big, the opportunities too broad. The very nature of an ecosystem is collaborative. That’s why this isn't just an announcement of our plans; it's an open invitation.

How You Can Be Part of This Journey

- Creators & Journalists (Austin pilot): Working on a project that resonates? Seeking new ways to fund impactful work and connect more deeply with your audience? Watch for IHJ’s pilot programs.

- Readers & Potential Backers: Passionate about quality journalism and creativity? Believe in deeper alignment and participation? An easy way to support us is to visit our merch store. Follow our progress and prepare to support stories through our initial donation-based model, then explore Story-Stocks.

- Thinkers, Innovators, Advocates: Have insights on media sustainability, platform ethics, or community finance? Join the conversation—challenge our assumptions and help refine these ideas.

- Potential Partners (Media Outlets, Foundations, Community Groups): Intrigued by strengthening Austin’s creative ecosystem? We’re seeking collaborators for our pilot phase—let’s explore working together.

What’s Next for InHouse Journal?

Our immediate focus is launching the Austin Journalism Funding Pilot. We’re partnering locally to bring the first community-funded stories to life through a transparent, donation-based model. This “Service Stage” will test our technology, build trust, and generate learnings.

From there, we’ll continue developing InHouse Financial and the infrastructure needed to introduce Story-Stocks, always guided by our commitment to a trustworthy, empowering ecosystem.

The Future is Integrated

The path ahead is complex and demanding, but filled with immense potential. By integrating diverse capabilities and placing trust and shared value at the center, we can forge a more sustainable, equitable, and vibrant future for the stories and creative works that enrich our lives and strengthen our communities.

This isn't just about InHouse Journal. It's about what we can build together. Let’s start.